Introduction

In the ever-changing world of foreign exchange (Forex), understanding and analyzing currency volatility is not just a skill but a necessity for traders. Volatility, the statistical measure of the dispersion of returns for a given currency pair, represents both risk and opportunity in Forex trading. This article delves into the intricate aspects of Forex Volatility Analysis, emphasizing its critical role in successful trading. We will explore various tools and strategies to measure and capitalize on currency volatility, providing a comprehensive guide for both novice and experienced traders.

What is Volatility in Forex?

Definition of Volatility in Forex

In the realm of Forex Volatility Analysis, volatility refers to the degree of variation or fluctuation in the exchange rate of a currency pair over a defined period. This concept is a cornerstone of currency trading, as it affects both the potential risks and rewards. High volatility in the Forex market signifies substantial fluctuations in currency values, often leading to increased trading opportunities but also higher risk. Conversely, low volatility suggests more stable and predictable currency movements, typically associated with lower risk but also lesser trading opportunities.

Factors Influencing Currency Volatility

Currency Volatility Measurement must consider a variety of factors that contribute to the fluctuating nature of the Forex market. Key among these are:

- Geopolitical Events: Political instability, elections, or conflicts can significantly impact a nation’s currency value, leading to increased volatility.

- Economic Reports: Data such as GDP growth, employment rates, and inflation can sway market perceptions and cause currency values to fluctuate.

- Monetary Policies: Decisions by central banks on interest rates and money supply are critical in Forex Volatility Analysis, as they directly influence currency strength.

- Market Sentiment: The collective attitude of investors towards a particular currency can also induce volatility. This sentiment can be swayed by news, rumors, or global economic trends.

- Global Crises: Events like financial crises or pandemics can lead to heightened volatility as they impact global economic stability and investor confidence.

Understanding these factors is essential for effective Forex market volatility analysis, enabling traders to anticipate potential market shifts and adjust their strategies accordingly.

Historical Volatility vs. Implied Volatility

In the domain of Forex Volatility Analysis, distinguishing between historical and implied volatility is crucial:

- Historical Volatility: This aspect of Currency pair volatility assessment focuses on analyzing past market behavior to understand how volatile a currency pair has been over a specific period. It provides a statistical measure based on historical price changes, offering insights into the typical movement patterns of a currency pair.

- Implied Volatility: A vital component of Forex Volatility Analysis, implied volatility looks forward, predicting future volatility based on current market data. It’s derived from the pricing of forex options and reflects the market’s expectation of future volatility. Implied volatility is particularly important for traders looking to gauge market sentiment and forecast potential price movements in the Forex market.

In summary, understanding and analyzing both historical and implied volatility is imperative for comprehensive Forex market volatility analysis. It enables traders to develop more informed strategies, whether they are looking to capitalize on high-volatility scenarios or seeking more stable trading environments in lower volatility conditions.

Measuring Volatility

Introduction to Volatility Measurement Tools

In the intricate world of Forex trading, Currency Volatility Measurement stands as a fundamental component. This process, crucial for comprehensive Forex Volatility Analysis, involves the use of various technical indicators and tools to assess market mood and gauge the potential for movement in currency pairs. These tools help traders to understand not just the present state of the market, but also to project future volatility, thereby shaping their trading strategies for optimum performance.

The Average True Range (ATR)

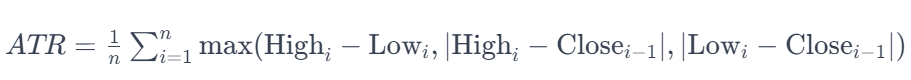

- Explanation and Calculation: The Average True Range (ATR) plays a central role in Currency Volatility Measurement. It measures market volatility by calculating the average range between the highest and lowest price points of a currency pair over a specified period. Typically, the ATR is calculated based on a 14-day period, but this can be adjusted to suit different trading styles and time frames. The ATR value gives traders a numerical insight into the volatility level of the currency pair, with higher values indicating greater volatility and vice versa.

- ATR in Volatility Assessment: The significance of ATR in Forex Volatility Analysis lies in its ability to help traders anticipate and prepare for potential price movements. By providing a historical volatility measure, traders can use ATR to set more accurate stop-losses, gauge the appropriateness of a trade, and even predict periods of high volatility, which may offer significant trading opportunities.

To harness the power of the ATR effectively, it’s crucial to understand how it’s calculated. The ATR formula is as follows:

Breaking this formula down:

- (n) represents the number of periods considered for the calculation. Typically, traders use a 14-day period, but this can be adjusted to suit individual preferences.

- High and Low correspond to the highest and lowest prices recorded on day (i).

- {Close}{i-1}) represents the closing price on the previous day.

The Volatility Index (VIX)

- Explanation and Significance: The Volatility Index, commonly referred to as the VIX and sometimes as the “fear index,” is a prominent tool in Forex Volatility Analysis. Unlike ATR, which is based on historical data, the VIX gauges the market’s expectation of future volatility derived from forex options prices. The VIX is often looked upon as a global benchmark for market sentiment, measuring the market’s expectation of volatility over the upcoming 30 days.

- VIX and Market Sentiment: The VIX is an invaluable predictor of market stress, sentiment, and fear. A high VIX value typically indicates heightened market fear, which often correlates with significant market downturns or instability, whereas a low VIX value suggests market complacency or stability. For Forex traders, the VIX is crucial in assessing the broader market environment, aiding in the formulation of strategies that align with current market sentiment.

Other Indicators for Measuring Volatility

In addition to the ATR and VIX, other technical indicators play a significant role in Forex market volatility analysis. Bollinger Bands, for instance, are used to measure the ‘bandwidth’ or the difference between the high and low prices of a currency pair relative to its moving average. This indicator can signal periods of low or high volatility, helping traders to identify potential breakout points. Other tools like the Standard Deviation indicator and the Momentum Oscillator also contribute valuable insights into market dynamics and volatility, thus enriching the overall approach to Forex Volatility Analysis.

Together, these tools form a comprehensive suite for Currency Volatility Measurement, providing traders with deep insights into the Forex market’s behavior and assisting in the development of robust trading strategies tailored to varying market conditions.

Trading Strategies Based on Volatility

High Volatility Strategies

High volatility in the Forex market offers unique opportunities for traders. These periods are characterized by rapid price movements, often driven by significant news events, economic reports, or geopolitical developments. In such environments, Forex Volatility Analysis becomes crucial to navigate the market effectively.

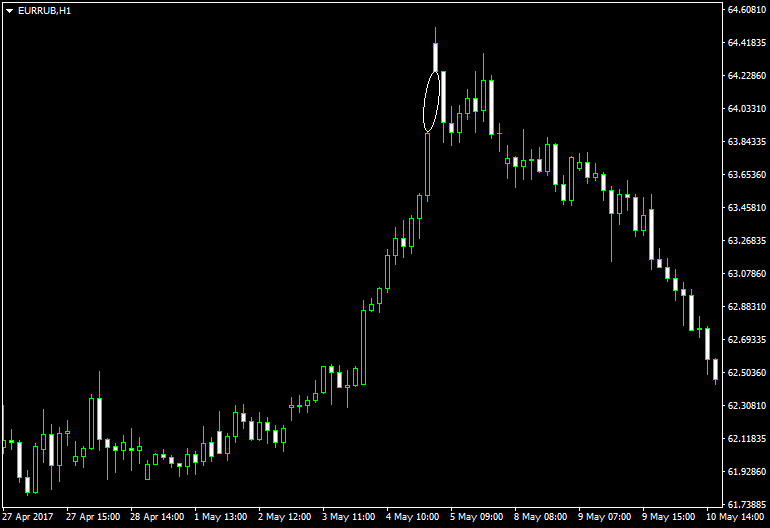

- Leveraging ATR and VIX: The Average True Range (ATR) and the Volatility Index (VIX) are indispensable tools in identifying periods of high volatility. A high ATR value suggests that a currency pair is experiencing larger than normal movements, signaling a high volatility phase. Similarly, a rising VIX indicates increased market fear, often correlating with high volatility in currency markets. Traders can use these indicators to adjust their strategies to suit the heightened market activity.

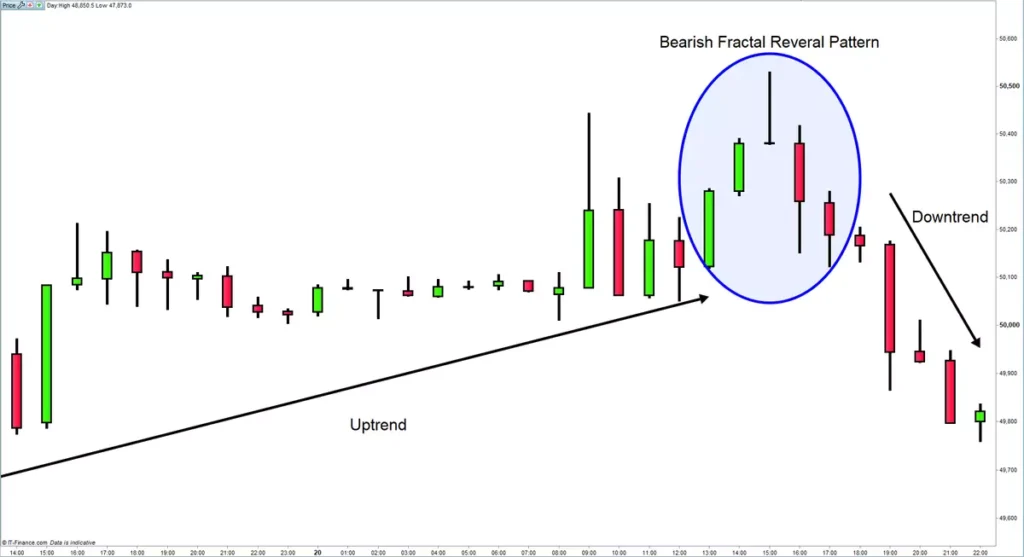

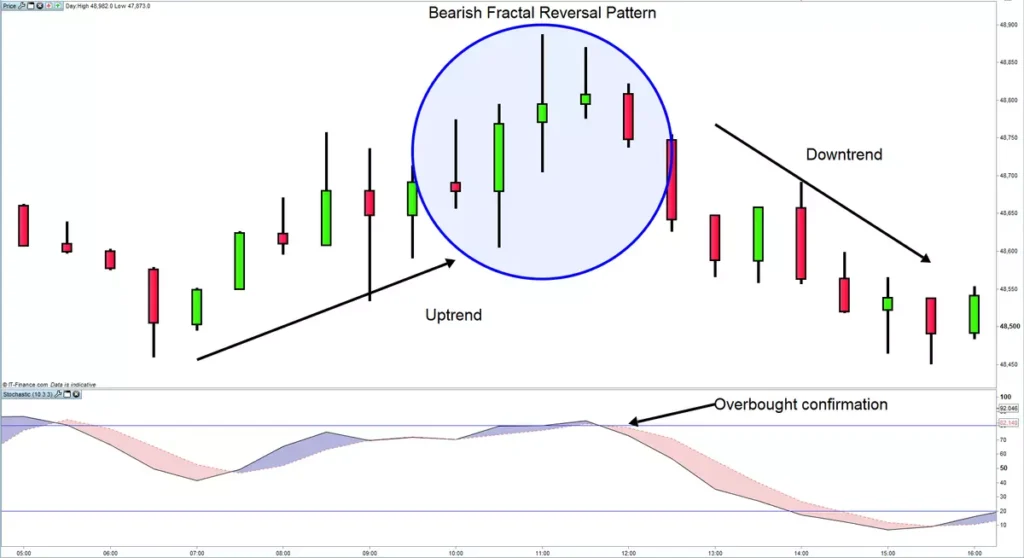

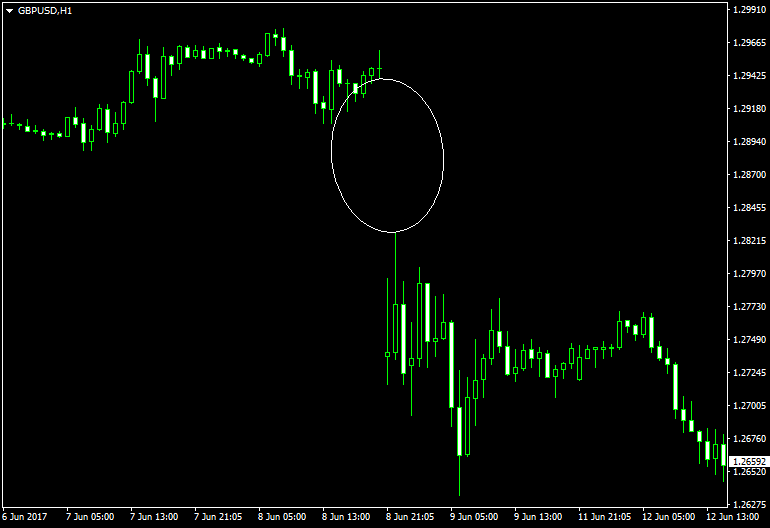

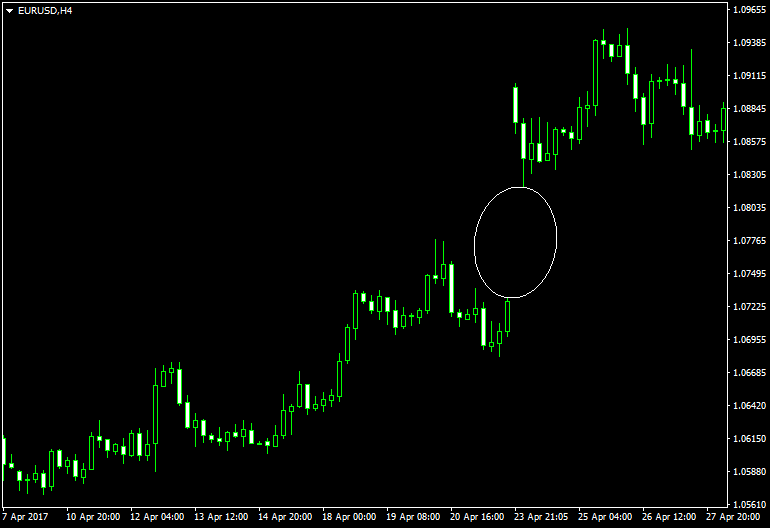

- Breakout Trading Setups: In high volatility, breakout strategies are often effective. Traders look for instances where the price breaks beyond a defined resistance or support level, indicating a strong market movement. Utilizing Forex Volatility Analysis, traders can identify potential breakout points, set entry and exit points, and manage risk accordingly.

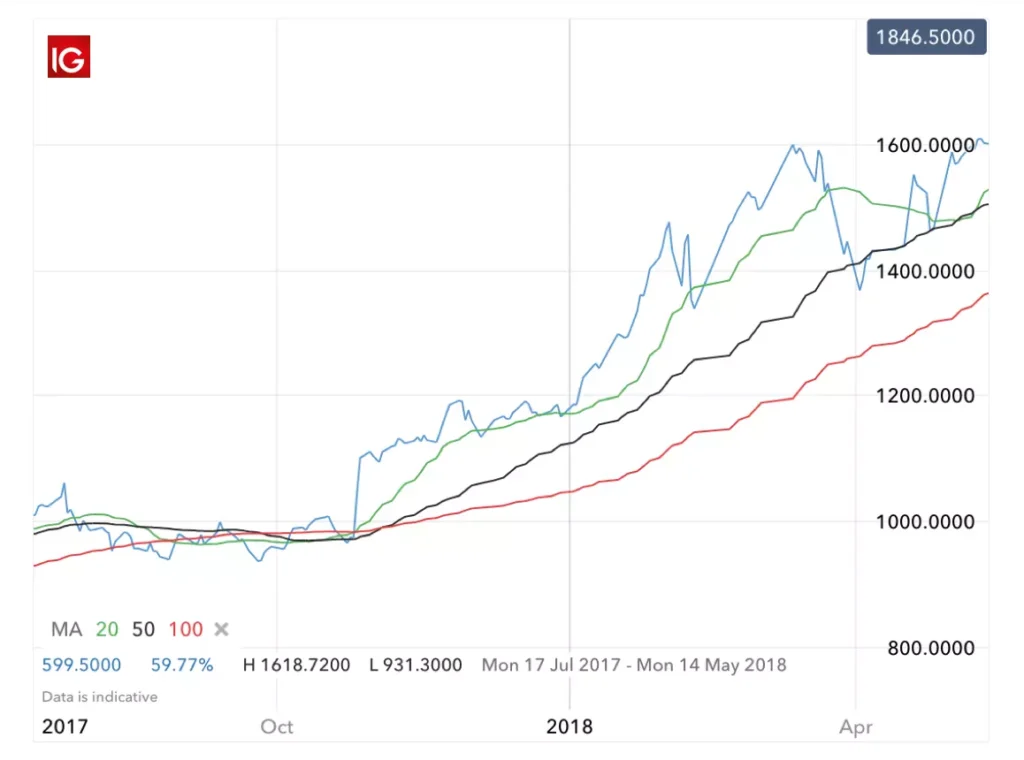

- Momentum Trading: This strategy capitalizes on the continuation of existing market trends during high volatility periods. By analyzing trends with tools like ATR and VIX, traders can ride the momentum of a currency pair, entering trades during a strong trend and exiting when signs of reversal appear.

Low Volatility Strategies

Conversely, low volatility in the Forex market is marked by smaller, more predictable price movements. Such conditions require a different approach, focusing on strategies that capitalize on the stability and lesser degree of fluctuation.

- Importance of ATR and VIX in Low Volatility: The role of ATR and VIX in Forex Volatility Analysis is equally critical in low volatility conditions. A lower ATR value indicates a phase of lesser market movement, which is typical of low volatility periods. A lower VIX suggests a calmer market, where drastic price movements are less likely.

- Range Trading: In low volatility scenarios, range trading becomes a viable strategy. Traders identify stable currency pairs that are fluctuating within a specific price range and trade between the defined support and resistance levels. This strategy relies on the predictability of price movements within the range.

- Scalping: Scalping involves making numerous trades to profit from small price changes. In low volatility conditions, this strategy can be particularly effective as it exploits the smaller, more predictable movements. Scalpers use Forex Volatility Analysis to identify currency pairs with minimal fluctuation and apply fast, short-term trades to accumulate gains.

In summary, Forex Volatility Analysis plays a pivotal role in formulating effective trading strategies, whether in high or low volatility conditions. By leveraging tools like ATR and VIX, traders can adapt their approaches to align with the current market environment, maximizing their potential for profitability while managing risk.

Risk Management in Volatile Markets

Importance of Risk Management

In the unpredictable arena of Forex trading, effective risk management is crucial, especially in volatile markets. This aspect of Forex Volatility Analysis is not just about protecting capital but also about maximizing profitability under varying market conditions. Volatility can be a double-edged sword: it presents opportunities for significant profits, but also exposes traders to higher risk. Therefore, implementing robust risk management strategies is vital to navigate these turbulent waters successfully.

Position Sizing and Stop-Loss

One of the key components of managing risk in volatile Forex markets is through careful position sizing and the strategic use of stop-loss orders.

- Position Sizing: This involves determining the appropriate amount of capital to risk on a single trade, considering the current volatility. The goal is to balance the potential for profit with the risk of loss. In high volatility conditions, it might be prudent to reduce position size to mitigate risk.

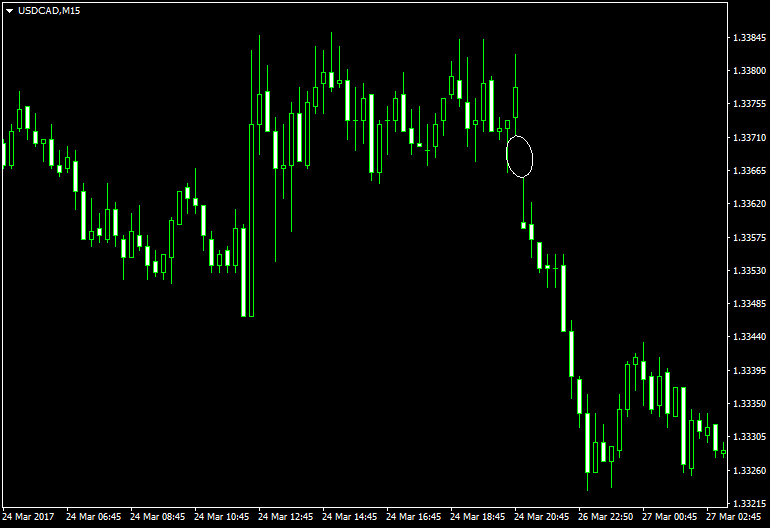

- Stop-Loss Orders: Stop-loss orders are an essential tool for Forex traders, allowing them to specify a price at which their position will automatically close to prevent further losses. The use of tools like the Average True Range (ATR) in setting these levels is a critical aspect of Forex Volatility Analysis.

Using ATR for Stop-Loss Levels

The ATR indicator is particularly beneficial in setting stop-loss orders in volatile markets.

- ATR-Based Stop-Loss: By measuring the average volatility over a specific period, ATR helps in identifying a stop-loss level that is neither too tight (triggering a premature exit) nor too loose (exposing the trader to excessive risk). The idea is to set the stop-loss at a level that allows the position enough ‘room to breathe’ while still protecting against significant losses.

- Dynamic Adjustments: As market volatility changes, ATR provides a way to dynamically adjust stop-loss levels. This ensures that the risk management strategy remains consistent with the current market conditions.

Hedging Strategies

In addition to position sizing and stop-loss orders, hedging is another important strategy in the arsenal of risk management in volatile Forex markets.

- Hedging as a Protective Measure: Hedging involves taking an opposite position in a related asset or using financial instruments like options to offset potential losses in your primary position. This method is particularly useful during periods of extreme volatility as part of Forex Volatility Analysis.

- Diverse Hedging Techniques: Common hedging techniques in Forex include currency pairs correlation where traders open positions in pairs that are inversely related, or options strategies like buying put options to protect against potential downside.

In conclusion, risk management in volatile Forex markets is a multifaceted approach that requires a deep understanding of market dynamics and an adept use of tools like ATR for effective implementation. By integrating these strategies into their trading practices, Forex traders can better protect their investments while taking advantage of the opportunities presented by market volatility.

Case Studies

Application of ATR and VIX

Real-world case studies provide invaluable insights into the practical applications of the Average True Range (ATR) and the Volatility Index (VIX) in Forex Volatility Analysis. These examples demonstrate how these tools can guide trading decisions and strategies, emphasizing their utility in navigating the Forex market.

- Case Study 1: ATR in Action: Consider a scenario where a Forex trader uses ATR to assess the volatility of EUR/USD. Over a period, the ATR indicates an increasing trend in volatility. The trader, recognizing this change, adjusts their trading strategy to accommodate the higher risk, reducing position sizes and setting wider stop-loss margins. This proactive approach helps the trader manage risk effectively during a period of heightened market movement.

- Case Study 2: VIX as a Market Indicator: In another instance, a trader observes a sharp rise in the VIX, signaling increased market fear and uncertainty, possibly due to an impending economic report or geopolitical event. Anticipating higher volatility in currency pairs, especially those sensitive to the event, the trader uses this insight to either avoid entering new positions or to hedge existing ones, thereby protecting their portfolio from potential adverse movements.

Trading Outcomes

Comparing trading outcomes with and without the use of Forex Volatility Analysis tools like ATR and VIX can be enlightening, illustrating the importance of these metrics in Forex trading.

- Without Volatility Analysis: A trader who doesn’t utilize tools like ATR and VIX may find themselves frequently caught off-guard by sudden market movements. For example, without the insight provided by ATR, a trader might set too tight a stop-loss, resulting in frequent and possibly unnecessary exits from positions. Similarly, ignorance of VIX levels might lead to a lack of preparedness for market-wide volatility events, resulting in significant losses or missed opportunities.

- With Volatility Analysis: Conversely, a trader who incorporates ATR and VIX into their Forex Volatility Analysis is better equipped to anticipate market changes. This trader can adjust their strategies dynamically, aligning their trading approach with the current market conditions. For instance, during periods of high volatility indicated by VIX, they might employ strategies more suited to such conditions, like breakout trading, while in lower volatility periods, as suggested by a lower ATR, they might focus on range trading or scalping strategies.

These case studies underscore the value of ATR and VIX in Forex Volatility Analysis. By leveraging these tools, traders can make more informed decisions, manage risks more effectively, and potentially improve their trading outcomes.

Tips for Effective Volatility Analysis

Incorporating ATR and VIX

Effective Forex Volatility Analysis hinges on the strategic incorporation of key tools like the Average True Range (ATR) and the Volatility Index (VIX). These tools should be integral components of a trader’s daily routine.

- Regular Analysis with ATR and VIX: Consistently monitoring ATR and VIX values can provide traders with a clear understanding of the market’s volatility landscape. For instance, a rising ATR may signal increasing market volatility, prompting traders to adopt strategies suitable for such conditions. Similarly, a high VIX reading might suggest heightened market fear, indicating a need for more cautious trading approaches or risk management strategies.

- Integrating Tools into Trading Platforms: Many modern trading platforms allow for the integration of various analytical tools. Traders should take advantage of these features to keep ATR and VIX readings readily accessible, enabling quick and informed decision-making.

Staying Updated on Economic Events

A key aspect of Forex Volatility Analysis is staying abreast of global economic events and news, as they can have significant impacts on currency markets.

- Economic Calendars: Utilizing economic calendars to track upcoming events like central bank meetings, economic data releases, or geopolitical events can help traders anticipate changes in volatility. Being aware of these events allows for proactive strategy adjustments in anticipation of increased market movements.

- News and Analysis Sources: Regularly following trusted financial news sources and analyses can provide deeper insights into how global events might affect currency volatility. This ongoing education can enhance a trader’s ability to respond effectively to market changes.

Adaptability

In the dynamic Forex market, adaptability is crucial for successful Forex Volatility Analysis. Market conditions can change rapidly, and strategies that work well under one set of conditions may not be effective under another.

- Flexible Trading Strategies: Traders should develop a range of strategies suitable for different volatility levels. For instance, in high volatility periods, strategies focusing on breakout trades may be more effective, whereas in lower volatility, range-bound strategies might yield better results.

- Continuous Learning and Practice: Engaging in continuous learning and practicing different strategies in various market conditions can help traders become more adaptable. Utilizing demo accounts to test strategies under different volatility scenarios can be a practical approach to honing adaptability skills.

- Emotional Discipline: Maintaining emotional discipline is key, especially during periods of high volatility. Traders should avoid impulsive decisions driven by fear or greed and stick to their trading plan, adapting strategies based on objective analysis rather than emotional reactions.

In conclusion, effective Forex Volatility Analysis is a multifaceted discipline that requires the regular use of analytical tools like ATR and VIX, staying informed about global economic events, and maintaining a flexible, disciplined approach to trading. By incorporating these practices, traders can enhance their ability to navigate the Forex market’s volatility, potentially leading to more successful trading outcomes.

Conclusion

Forex Volatility Analysis, particularly through tools like ATR and VIX, is indispensable in Forex trading. It equips traders with the knowledge to navigate through turbulent market conditions effectively. As the Forex market continues to evolve, adapting and integrating these analytical tools and strategies will remain vital for trading success.

Click here to read our latest article on Sovereign Wealth Funds

FAQs

FAQs on Forex Volatility Analysis

- What is Forex Volatility Analysis?

Forex Volatility Analysis is the process of understanding and assessing the degree of fluctuation in currency pair prices in the Forex market over a specific period. It involves using various tools and indicators to measure and predict market movements. - Why is understanding volatility important in Forex trading?

Understanding volatility is crucial because it helps traders gauge the potential risk and opportunity in currency pair movements. It assists in making informed trading decisions, setting appropriate risk management strategies, and identifying the most suitable trading opportunities. - How is the Average True Range (ATR) used in Forex Volatility Analysis?

The ATR is used to measure the degree of market volatility by calculating the average range between the highest and lowest price points of a currency pair over a specified period. This helps traders in setting stop-loss orders, adjusting position sizes, and anticipating market movements. - What does the Volatility Index (VIX) indicate in Forex trading?

The VIX, often referred to as the “fear index,” indicates the market’s expectation of volatility over the coming period. A high VIX value suggests increased market fear and uncertainty, often signaling higher market volatility. - Can volatility analysis predict currency price movements?

While volatility analysis can provide insights into the potential degree of price movements, it does not predict the direction of these movements. It is more about preparing for the scale of changes rather than the specific direction. - What are some common strategies for trading in high volatility conditions?

Common strategies include breakout and momentum trading setups, where traders capitalize on rapid price movements. These strategies require careful risk management and an understanding of market triggers. - How do traders manage risk in volatile Forex markets?

Risk management in volatile Forex markets involves setting appropriate stop-loss orders, adjusting position sizes based on volatility assessments, and employing hedging strategies to mitigate potential losses. - What is the role of economic events in Forex Volatility Analysis?

Economic events play a significant role as they can cause substantial fluctuations in currency values. Keeping track of economic calendars and news helps traders anticipate changes in volatility and adjust their strategies accordingly. - How important is adaptability in Forex trading?

Adaptability is crucial in Forex trading due to the market’s dynamic nature. Traders need to be flexible in their strategies, adapting to varying levels of market volatility and changing market conditions to maintain profitability. - Are there any specific tools for measuring low volatility in the Forex market?

Tools like the ATR are also effective in measuring low volatility, with lower ATR values indicating more stable and predictable market conditions. Traders often use range-bound strategies in such low volatility scenarios.

Click here to learn more about Forex Volatility Analysis