Introduction

Forex Market Gaps represent significant opportunities for traders. Understanding these gaps in the Forex market is crucial for both novice and experienced traders. This article aims to demystify Forex Market Gaps, exploring their types, causes, and strategies for effective trading.

Types of Forex Market Gaps

In the realm of Forex trading, market gaps are intriguing phenomena that manifest as distinct breaks in price movement on a chart. These gaps are pivotal in Forex Market Gaps analysis and can be classified into four primary types: common gaps, breakaway gaps, runaway gaps, and exhaustion gaps. Each type of gap not only has unique characteristics but also holds different implications for trading strategies and decisions.

Common Gaps

Common gaps are frequently encountered in the Forex market. They typically occur in areas of price consolidation and do not necessarily indicate a significant market movement. These gaps are often filled quickly, meaning the price returns to the original pre-gap level. For traders, common gaps may not provide substantial trading opportunities due to their short-lived nature and lack of directional momentum.

Breakaway Gaps

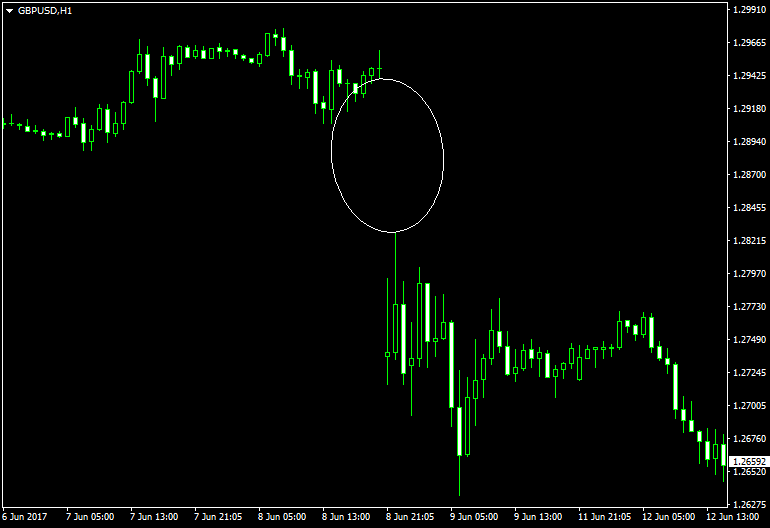

Breakaway gaps are significant in Forex Market Gaps analysis as they signal the start of a new trend or a major price movement. These gaps usually occur after a period of price consolidation and are accompanied by high trading volume. They represent a clear departure from the previous price range, setting the stage for a new trend. Traders often view breakaway gaps as an opportunity to enter the market in the direction of the gap, anticipating a new trend.

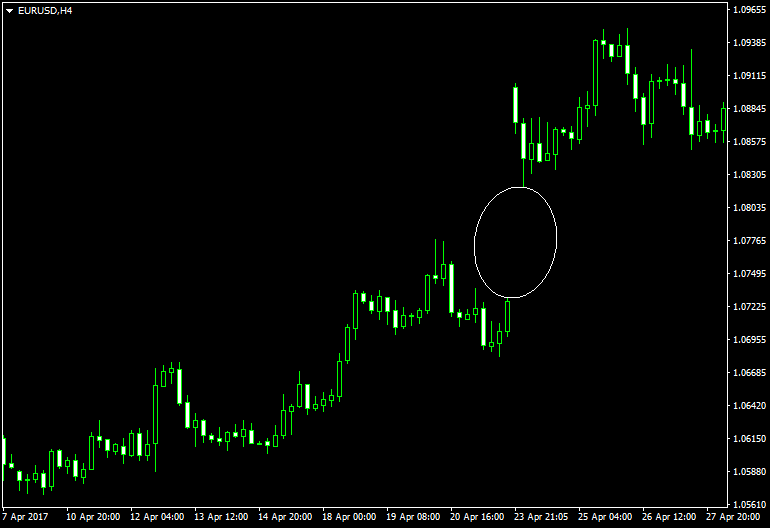

Runaway Gaps

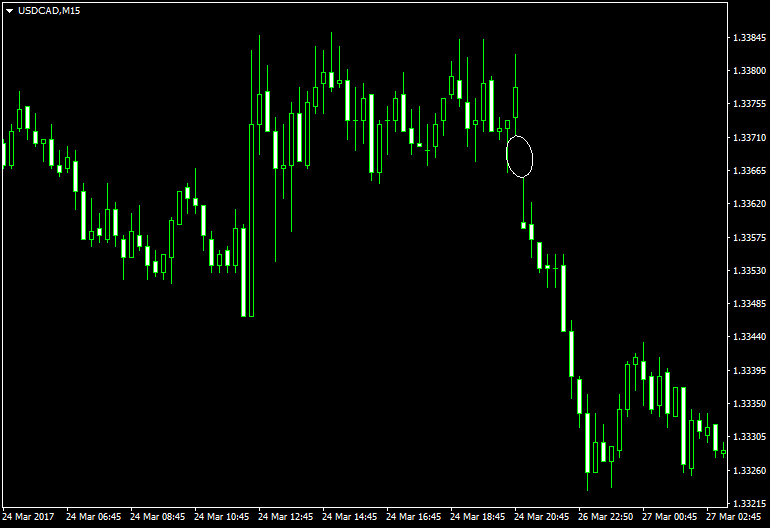

Also known as continuation gaps, runaway gaps are indicative of an already established trend gaining further momentum. These gaps occur in the midst of a trend and suggest that the price is moving strongly in one direction. Runaway gaps can be valuable for traders as they reinforce the existing trend and can be used to add to or adjust existing positions in line with the ongoing trend.

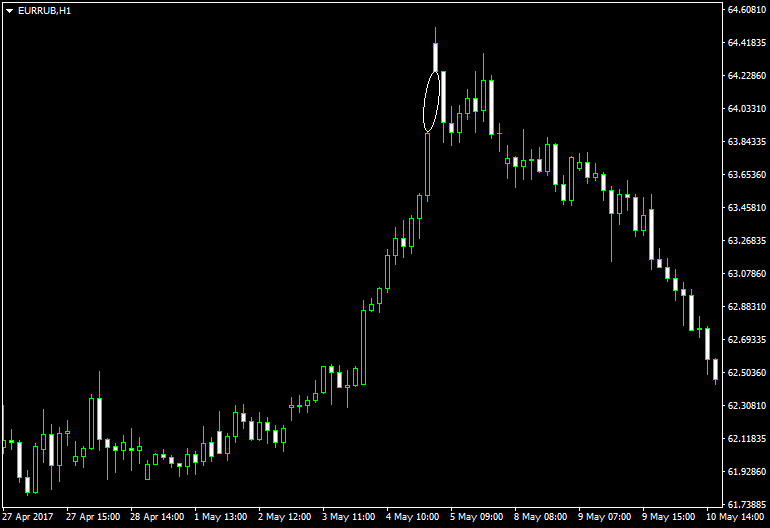

Exhaustion Gaps

Exhaustion gaps occur towards the end of a price trend and signify the final push before a trend reverses or loses momentum. These gaps are characterized by a noticeable spike in price movement, but unlike runaway gaps, they do not sustain the trend. Instead, they often lead to a trend reversal. Traders use exhaustion gaps as signals for potential trend reversals, making them crucial in planning exit strategies or preparing for a new opposing trend.

Causes of Market Gaps

Understanding the causes behind market gaps is essential for traders employing Forex Market Gaps strategies. These gaps can arise from a variety of factors, each influencing the Forex market in distinct ways. Recognizing these can help traders in better anticipating and navigating through these gaps. The primary causes include Weekend Gap Trading situations, News-Driven Gap Strategies, economic events, and liquidity issues.

Weekend Gap Trading

Weekend gaps typically occur due to the closure of the Forex market over the weekend. Since the market is closed, it does not react to news or events happening during this period until it reopens. When it does, there can be a significant price difference between Friday’s close and Sunday’s open, resulting in a gap. Weekend Gap Trading strategies revolve around predicting and responding to these gaps, which can be substantial depending on the events over the weekend.

News-Driven Gap Strategies

News-driven gaps are a result of significant news events or economic reports that can cause sudden and sharp movements in currency prices. These gaps are often more unpredictable and can occur rapidly. News such as political developments, economic policy announcements, or release of economic data like employment rates, GDP, or interest rate changes can all lead to news-driven gaps. Forex traders utilizing News-Driven Gap Strategies must stay well-informed and react quickly to news events to capitalize on these gaps.

Economic Events

Apart from regular news, specific economic events can also lead to market gaps. These events include central bank announcements, economic summits, or unforeseen geopolitical events. The anticipation or reaction to these events can cause sudden shifts in market sentiment, leading to price gaps. Traders must monitor economic calendars and global events closely as part of their Forex Gap Analysis to predict potential market reactions.

Liquidity Issues

Liquidity gaps occur when there is a lack of sufficient trading volume or liquidity in the market to support smooth price movements. These gaps can be more prevalent in less popular currency pairs or during off-market hours. A sudden order in a low liquidity environment can cause the price to jump, creating a gap. Understanding liquidity levels is crucial for traders, especially when trading less popular pairs or during times of low market activity.

In summary, market gaps in Forex trading are influenced by a combination of Weekend Gap Trading situations, news-driven events, broader economic events, and liquidity factors. Effective Gap Trading Techniques and comprehensive Forex Gap Analysis involve understanding and anticipating these factors, allowing traders to navigate market gaps strategically and enhance their trading effectiveness.

Trading Weekend Gaps

Weekend gaps in Forex trading present unique challenges and opportunities. These gaps occur because the Forex market closes on Friday and reopens on Sunday, and any significant events during the weekend can lead to a difference in price between Friday’s close and Sunday’s open. Understanding how to navigate and trade these weekend gaps is crucial for Forex traders, especially those focusing on Weekend Gap Trading strategies.

Understanding Weekend Gaps

A weekend gap occurs when there is a significant price jump between the closing price on Friday and the opening price on Sunday. This can be due to economic, political, or social events that happen over the weekend when the market is closed. Traders need to understand that these gaps can move in either direction, up or down, and the size of the gap can vary significantly.

Trading Strategies for Weekend Gaps

When it comes to trading weekend gaps in Forex, the strategies typically involve the use of limit and stop orders. These orders are placed at strategic points where the trader anticipates the market will move upon opening after the weekend.

- Limit Orders for Weekend Gap Trading: Limit orders can be set at the Friday closing price or just before the gap, with the anticipation that the price will revert to its original position. This strategy is based on the premise that gaps will eventually be filled, meaning the price will return to its pre-gap level.

- Stop Orders to Capitalize on Gap Movement: Conversely, stop orders can be placed in the direction of the gap. If a trader believes that the weekend gap signifies a continued move in that direction, stop orders can be an effective way to capitalize on this movement.

- Risk Management in Weekend Gap Trading: Regardless of the strategy, risk management is crucial when trading weekend gaps. This includes setting appropriate stop-loss orders to protect against unexpected market movements and managing position sizes to mitigate potential losses.

Real-World Examples

Consider a scenario where a major political event occurs over the weekend, and it is expected to negatively impact a particular currency. Traders might set a sell limit order just below the Friday closing price, anticipating a drop in the currency’s value when the market opens. If the market opens lower as anticipated, the sell order will be executed, potentially leading to profits if the price continues to drop.

In another instance, if there’s positive news over the weekend that is likely to boost a currency, traders might place a buy stop order above the Friday closing price. If the market opens higher and continues to rise, this can result in a profitable trade.

Trading weekend gaps in the Forex market involves a combination of strategic planning, market analysis, and robust risk management. By understanding the nature of weekend gaps and using appropriate trading techniques, Forex traders can take advantage of these market occurrences. However, it’s important to remember that while these strategies can be profitable, they also carry risks, and traders should always be prepared for different market scenarios.

Trading News-Driven Gaps

News-Driven Gap Strategies are a critical component of Forex trading, as they involve responding to market gaps created by significant news releases. These gaps occur due to the immediate reaction of the market to news events, often leading to sudden and substantial price movements. Understanding how to trade these news-driven gaps can be highly beneficial for Forex traders.

Preparing for News Releases

Preparation is key when it comes to trading news-driven gaps in the Forex market. Traders need to stay updated with economic calendars and be aware of upcoming major news events, such as central bank announcements, economic data releases, or geopolitical events that could impact the currency markets. Anticipating these events and understanding their potential impact on different currency pairs is crucial.

- Monitoring Economic Calendars: Regularly check economic calendars for upcoming news events and their expected impact.

- Analyzing Potential Outcomes: Consider various scenarios based on potential news outcomes and plan trading strategies accordingly.

- Setting Up Alerts: Use trading software or apps to set alerts for major news releases to ensure timely reactions.

Trading the Initial Gap

Once a news event occurs, the initial market reaction often results in a gap. Trading this initial gap requires swift action.

- Immediate Entry: Some traders choose to enter a trade immediately after the gap occurs, predicting the direction based on the news released.

- Wait for Initial Fluctuation: Others prefer to wait for the initial volatility to settle before entering, as the first reaction can sometimes be misleading.

Strategies for Gap Continuation

After the initial gap, the market may continue in the same direction or reverse. Traders need to be prepared for both scenarios.

- Follow-through Trades: If the gap continues in the same direction, traders may look for additional entry points to capitalize on the trend.

- Reversal Trades: If the market shows signs of reversing, traders can look for opportunities to trade against the initial gap movement.

Case Studies

Real-world case studies of news-driven gaps provide valuable insights. For instance, a surprise interest rate cut by a central bank might lead to a sharp decline in that country’s currency. Traders who anticipate this move can place sell orders immediately after the announcement. Alternatively, if the market starts to reverse, perhaps due to an overreaction, traders might find profitable opportunities in buying the currency at a lower rate.

Another case could involve employment data releases. If the data is significantly better or worse than expected, it can create substantial currency movements. Traders can take advantage of these movements by either trading in the direction of the gap or waiting for a potential reversal if the market overreacts.

Trading News-Driven Gaps in Forex involves a combination of careful preparation, quick reaction to news releases, and adaptability to the market’s response. By understanding how to trade both the initial gap and its continuation, and by learning from past case studies, traders can develop effective strategies for capitalizing on these market opportunities. However, as with all trading strategies, risk management and a thorough understanding of market dynamics are essential.

Risk Management and Stop-Loss Orders

In the volatile world of Forex Market Gaps trading, effective risk management is not just a best practice; it’s a necessity for long-term success. Understanding and implementing robust risk management strategies, particularly in the context of stop-loss orders, position sizing, and leverage management, is crucial for navigating the uncertainties associated with market gaps.

Setting Appropriate Stop-Loss Orders

Stop-loss orders are a vital component of risk management in Forex Market Gaps trading. These orders help traders limit potential losses by automatically closing a position at a predetermined price level.

- Determining Stop-Loss Levels: The placement of stop-loss orders should be based on a thorough analysis of market conditions and the specific characteristics of the gap being traded. It’s crucial to set these orders at a level that balances the potential for profit and the risk of loss.

- Using Technical Analysis: Technical indicators and historical price levels can provide insights into where to set stop-loss orders. For instance, placing a stop-loss just below a key support level can protect against downward gaps.

- Adjusting to Market Volatility: In times of high volatility, such as during major news releases, wider stop-losses may be necessary to accommodate larger price swings and prevent premature trade exits.

Managing Position Sizing and Leverage

The size of a position and the amount of leverage used are pivotal in risk management, especially in the context of trading Forex Market Gaps.

- Calculating Position Size: It’s important to determine the appropriate position size for each trade based on the overall account balance and the risk tolerance of the trader. A common rule is not to risk more than a certain percentage (often 1-2%) of the account balance on a single trade.

- Understanding Leverage: While leverage can amplify profits, it can also magnify losses, especially in gap trading where market moves can be substantial. Traders should use leverage cautiously, understanding the potential risks and keeping leverage at a manageable level.

- Balancing Risk and Reward: The potential reward of a trade should justify the risk taken. Traders need to assess the risk/reward ratio of a gap trading opportunity to ensure it aligns with their trading strategy and goals.

Effective risk management in Forex Market Gaps trading is about more than just protecting capital; it’s about making strategic decisions that balance potential profits against possible risks. By setting appropriate stop-loss orders, managing position sizes wisely, and using leverage judiciously, traders can navigate the challenges of gap trading and work towards achieving consistent trading results. Remember, successful gap trading is not just about the trades you win but also about how you manage the trades that don’t go as planned.”

Common Pitfalls and Mistakes

Trading Forex Market Gaps can be a lucrative endeavor, but it’s fraught with potential pitfalls that can hinder performance. Identifying and understanding these common mistakes is crucial for traders looking to enhance their strategy and avoid costly errors.

Misinterpreting the Gap’s Significance

One of the most common mistakes in Forex Market Gaps trading is misinterpreting the significance of a gap. Not all gaps signal a strong trading opportunity. For instance, mistaking a common gap for a breakaway gap could lead to misguided trades. It’s essential to analyze the context in which a gap occurs, considering factors like market trends, news events, and trading volume.

Inadequate Preparation for News Releases

Another pitfall is inadequate preparation for news-driven gaps. Traders may either miss the signs of an impending news release or misjudge its potential impact. This lack of preparation can result in missed opportunities or unexpected losses. Keeping an up-to-date economic calendar and understanding the potential market impacts of upcoming news events are critical steps in preparing for news-driven gaps.

Neglecting Risk Management

Perhaps the most critical mistake traders make is neglecting proper risk management, especially in the volatile environment of gap trading. Failing to set appropriate stop-loss orders, overleveraging positions, or risking too much capital on a single trade can lead to significant losses. Effective risk management involves not only protecting against losses but also ensuring that trading actions are aligned with one’s overall trading plan and risk tolerance.

Overtrading or Chasing the Market

Overtrading or chasing the market after a gap has occurred is another common error. In the rush to capitalize on a gap, traders may enter the market without a clear strategy or exit plan. This impulsive trading often leads to poor decision-making and increased transaction costs. Patience and discipline are key; not every gap presents a viable trading opportunity.

Failing to Adjust to Market Feedback

Successful Forex Market Gaps trading requires adaptability. A common pitfall is failing to adjust strategies in response to market feedback. If a trading approach isn’t yielding the expected results, it may be time to reevaluate and adjust the strategy. This could involve refining gap analysis techniques, tweaking risk management practices, or even taking a break to reassess one’s approach.

Avoiding these common pitfalls in Forex Market Gaps trading requires a combination of thorough market analysis, disciplined strategy implementation, and consistent risk management. By recognizing and learning from these common mistakes, traders can enhance their ability to navigate the complexities of gap trading and improve their overall trading performance. Remember, in the dynamic world of Forex trading, continuous learning and adaptation are key to long-term success.

Conclusion

Concluding the article, we’ll recap the key aspects of Forex Market Gaps and their trading strategies. We’ll encourage traders to practice and refine their gap trading skills, highlighting the potential rewards of mastering this aspect of Forex trading.

Click here to read our latest article on Forex Grid Trading

FAQs

- What are Forex Market Gaps? Forex Market Gaps are areas on a chart where no trading occurs, resulting in a visible gap between two price levels. They usually happen due to significant price movements caused by market events or news.

- What causes Forex Market Gaps to occur? Gaps in the Forex market typically occur due to factors like major news events, economic data releases, weekend closures (leading to Weekend Gap Trading), and liquidity issues.

- Can you explain Weekend Gap Trading? Weekend Gap Trading refers to a strategy that focuses on gaps that occur between the Friday close and the Sunday open of the Forex market, often caused by events or developments that take place over the weekend.

- What are News-Driven Gap Strategies? News-Driven Gap Strategies involve trading decisions based on gaps created by significant news releases or economic events that cause immediate and substantial market reactions.

- How do I trade a news-driven gap? To trade a news-driven gap, prepare for potential market moves before the news release, execute trades based on the initial gap, and consider trading the continuation of the gap movement, if applicable.

- What are the different types of market gaps? The four main types of market gaps are common gaps, breakaway gaps, runaway (or continuation) gaps, and exhaustion gaps, each with unique characteristics and trading implications.

- How important is risk management in trading Forex Market Gaps? Risk management is crucial in gap trading to mitigate potential losses. It involves setting stop-loss orders, managing position sizes, and being cautious with leverage.

- What are some common mistakes in gap trading? Common mistakes include misinterpreting the type or significance of gaps, neglecting risk management, overtrading, and failing to adjust strategies based on market feedback.

- Can gap trading be automated? While some aspects of gap trading can be automated, particularly in identifying gaps, it’s important for traders to manually assess and manage trades due to the complexity and volatility associated with gaps.

- How can I improve my gap trading skills? To improve gap trading skills, focus on continuous learning, keep up-to-date with market news, practice disciplined risk management, and analyze past trades to learn from successes and mistakes.

Click here to learn more about Forex Market Gaps